For Non-LACA auction property, you have to settle payment to bank that auction the property within 120 days, if not the bank has the right to re-auction it. Meaning to say, your deposit will be forfeited if it is re-auction.

This is my experience of going through the legal process after winning the bid of non-LACA & vacant auction property.

What is Non-LACA Property

Non-LACA property means the title is already issued to an individual owner while LACA the property / land title still under master title which is under housing developer’s name.

Non-LACA property will be auctioned at high court and it is safer vs LACA auction where there is a possibility of delay due to double transfer.

You can refer my previous article on Non-LACA & LACA auction type.

What It Means To Settle within 120 Days

It means that you must pay up the balance of auction value within 120 days. If you take loan, your applied bank must release the payment to the bank that auction the property within 120 days.

Even though the transfer of name is not yet completed but the payment is already released than it is consider safe (no more re-auction).

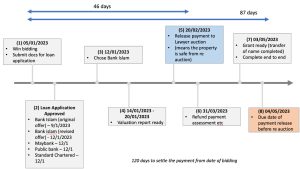

Refer to diagram – freehold property with ready title legal process timeline, the property is safe from re-auction if you reach #5, even though you haven’t complete the whole legal process yet.

Important Documents to Settle for Fast Loan Disbursement

For my auction property, I use Bank Islam for my housing loan. In order for the bank to do execution process (mean start the process of loan disbursement), below documents must be ready.

- Valuation report

- MRTT / MRTA approval

- Stamping of Letter of Offer from Bank to Legal firm

- Previous owner land title documents (so the legal firm can cancel the previous owner caveat and insert new one)

If you take loan from bank, they will ask to take valuation report and MRTT from their panel.

For valuation report, it is advisable to get in touch immediately with the valuer firm even before Letter of Offer from bank comes out and request them to start doing the valuation for example taking photos and site visit.

MRTT, you need to fill in quickly the MRTT form application and push your banker to make it happens.

Besides, push your banker for the bank to issue quickly the LOA to the legal firm so they can do stamping and doing the legal works.

Previous land title documents are kept by legal firm appointed by the bank that auction the property. You must make sure you have that legal firm person in charge of the auction property and their contact details so you can share immediately with your legal firm so they can contact them asap.

After all those 4 documents are ready than the bank can start their execution process. You can follow up with your legal firm to push for it and get in touch with the banker to assist the lawyer in pushing their credit department.

My Experience – Timeline for Overall Legal Process

Based on my experience, the Bank Islam & its legal team able to complete the #5 steps within 46 days which is much earlier vs 120 days.

Usually bank will ensure the process is fast for auction property but it is still advisable to get banker & legal team who have auction property experience. I chose Bank Islam because when I did my study they were the one who was really responsive and knowledgeable in handling auction property.

Take note though, it doesn’t mean that all Banker or all Bank Islam legal firm are fast and responsive, ensure you do your own due diligence.

The Legal Team I Use

I’m really fortunate to have very responsive and knowledgeable legal team to support me. They are also helpful and explaining me the jargon of the legal process.

First time in my property investment, I met very responsive and helpful legal firm. Most of the time, the legal team is slow in responding.

Conclusion

This was my first time in successfully win a auction property. I was anxious whether the deal could be closed within 120 days because from normal property buying experiences, it always exceeds 120 days.

Fortunately, the deal is closed within 46 days based on my diligent follow through and choosing the right legal team and chose the right bank branch.